Streamlining Financial Accounting --Discount & Its types

- Dr.Abhishek Janvier Frederick frederick

- Aug 27, 2023

- 2 min read

Discount

A discount is a reduction in the initial price of a product or service to encourage sales, reward timely payments, or for other strategic reasons.

Cash discounts, trade discounts and quantity discounts are all examples of discounts.

Difference between cash and trade discount:

Cash Discount: The purpose of cash discount is to encourage customers to make payments on time.They encourage customers to pay their bills on time, which helps the seller increase cash flow.

Timing: Cash savings are generally available when the payment is completed within a certain time frame.Common terms include "2/10, net 30", which means that if payment is made within 10 days, a 2% deduction is given;Otherwise, the full amount will be due in 30 days.

Accounting Treatment: Cash discounts are recorded as a reduction in revenue. If the discount is taken, it reduces the accounts receivable or cash account. If the discount is not taken, the full amount is recorded.

Sales with Cash Discount:

Scenario: A company sold $1,000 worth of goods with credit terms "2/10, net 30." The customer takes advantage of the cash discount and pays within 10 days.

Journal Entry:

Accounting Process: Cash Discount

Trade discount:

Purpose: At the time of sale, trade discounts are offered to certain customers, such as wholesalers or retailers, based on their purchase volume.They are generally not related to pay timing.

Timing: Trade discount is applied before the invoice is created.These are used to establish selling prices for specific customers.

Accounting Treatment: The trade discount does not affect the accounting records.The seller simply sends the invoice to the customer at the discounted price.

Purchase with Trade Discount:

Scenario: A retailer purchases inventory from a supplier for $1,000 at a trade discount of 20%.

Accounting Process: Trade Discount

In the first instance, a cash discount was offered to encourage prompt payment.In another example, a trade discount was applied at the time of purchase, affecting the purchase price.Compound journal entries are useful for accurately capturing these complex transactions.

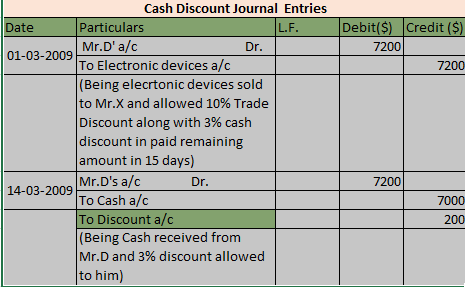

Payment with Both Cash and Trade Discounts:

Scenario: Mr.D purchased on 1st March 2009 $8,000 worth of electronics with a trade discount of 10% and is eligible for a cash discount of 3% if paid within 15 days.

Comments