Bookkeeping vs. Accounting: Unpacking the Numbers

- Dr.Abhishek Janvier Frederick frederick

- Aug 26, 2023

- 5 min read

Bookkeeping:

Recording of Transactions: Bookkeeping mainly involves the systematic recording of financial transactions. It involves documenting all day-to-day financial activities such as sales, purchases, payments and receipts.

Data Entry: Bookkeepers are responsible for entering financial data into ledgers, journals and accounting software. They ensure that each transaction is accurately recorded with details such as date, amount and category.

Organization: Bookkeepers maintain organized records, including accounts payable (money owed to others), accounts receivable (money owed to others), cash flow statements, and financial statements.

Basis of Accounting: Bookkeeping provides the basic data that accountants use to analyze and report on a company's financial performance. It is the raw data that forms the basis of accounting.

Attention to accuracy and detail: Bookkeepers must be meticulous and detail-oriented to ensure the accuracy of financial records. Mistakes in bookkeeping can lead to errors in financial statements.

Accounting:

Interpretation of Financial Data: Accounting involves not only recording financial transactions but also interpretation and analysis of financial data. Accountants use the data generated by bookkeepers to provide information about the financial health of a company.

Financial Reporting: Accountants prepare and present financial statements such as the income statement, balance sheet and cash flow statement. These reports provide a comprehensive view of a company's financial position and performance.

Financial Analysis: Accountants analyze financial data to make strategic decisions. They assess profitability, liquidity, solvency and other financial ratios to help management and stakeholders understand a company's financial position.

Compliance and Regulations: Accountants ensure that financial records and reports comply with relevant accounting standards and regulations. They may also prepare tax returns and ensure compliance with tax laws.

Budgeting and Forecasting: Accountants often play a role in budgeting and financial forecasting. They help in making financial plans for the future based on historical data and industry trends.

Decision-Making Support: Accountants provide financial insight and recommendations to help businesses make informed decisions, such as whether to invest in new projects, expand operations, or cut costs.

High-Level Analysis: While bookkeeping focuses on daily financial activities, accounting involves more complex financial analysis, including evaluating long-term investments and assessing the overall financial health of an organization.

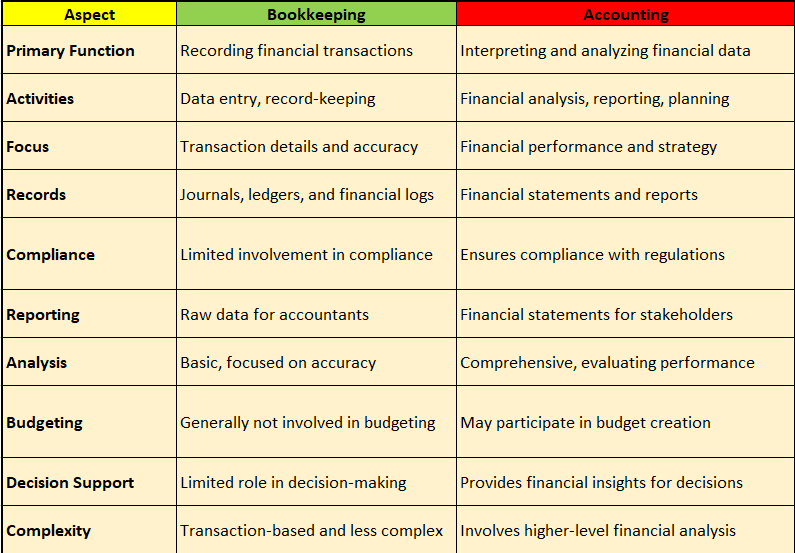

This table summarizes the key differences between bookkeeping and accounting in terms of their functions, activities, and roles within an organization's financial management.

10 reasons why Accounting is preferred over bookkeeping----Explained with examples

Accounting is generally preferred over bookkeeping for a number of reasons, as it provides a more comprehensive and valuable perspective on the financial health and strategic decision making of a business. Here are some of the major reasons why accounting is preferred:

1. Financial Analysis: Accounting involves the interpretation and analysis of financial data. It also goes beyond recording transactions to provide insight into a company's financial performance, trends and potential areas for improvement.

2. Strategic Decision Making: Accountants play a vital role in providing financial information and analysis that aid in strategic decision making. They help the management to make informed choices regarding investment, expansion, cost cutting and other important decisions.

3. Compliance and Regulation: Accountants ensure that a company's financial records and reports comply with relevant accounting standards and regulations. This helps the business avoid legal issues and maintain transparency with the stakeholders.

4. Financial Reporting: Accountants prepare comprehensive financial statements, including the income statement, balance sheet and cash flow statement, which provide an overall view of a company's financial position. These reports are required by shareholders, investors and creditors.

5. Budgeting and Forecasting: Accountants often participate in the budgeting and financial forecasting processes. They help make realistic financial plans for the future, guiding the company's growth and stability.

6. Taxation: Accountants are well-versed with tax laws and can optimize a company's tax strategy while ensuring compliance while minimizing tax liabilities.

7. Complex Financial Transactions: In cases involving complex financial transactions, mergers and acquisitions, or international operations, accounting expertise is necessary to accurately record and report these activities.

8. Financial Strategy: Accountants contribute to the development of financial strategies, which may include optimizing capital structure, managing working capital and assessing investment opportunities.

9. High-Level Analysis: Accounting involves high-level financial analysis, which also includes the evaluation of a company's long-term financial health, liquidity and solvency.

10. Decision Support: Accountants provide financial insights and recommendations to help businesses make informed decisions, thereby improving their overall financial performance.

While bookkeeping is important for maintaining accurate financial records and is often the starting point for financial management, accounting offers a broader and more strategic perspective. It adds value to business by providing the tools and insights needed to make good financial decisions and achieve long-term financial success. Thus, accounting is preferred when a deep understanding of financial data and its strategic implications is required.

Examples proving the supremacy of Financial accounting over Bookkeeping

Let us clarify why financial accounting is preferred over bookkeeping using fictitious companies in the United States:

Tech Innovators Inc. (Fictitious Company)

Bookkeeping Scenario:

Tech innovators inc. Totally dependent on bookkeeping. It records daily financial transactions, such as sales, purchases and expenses. Although it ensures basic financial record keeping, it lacks the depth needed for strategic decision making.

Accounting Scenario:

If Tech Innovators Inc. If a person opts for financial accounting, he gets a more comprehensive view of his financial position. Accountants prepare financial statements including the income statement and balance sheet. This allows a company to assess its profitability, evaluate its assets and liabilities, and make informed decisions about whether to expand its product range or invest in research and development.

Green Energy Solutions LLC (Fictitious Company)

Bookkeeping Scenario:

Green Energy Solutions LLC, a renewable energy company, relies entirely on bookkeeping to record its transactions, track expenses and manage payroll. Although it has basic financial records, it may have difficulty understanding its long-term financial viability.

Accounting Scenario:

By adopting financial accounting practices, Green Energy Solutions LLC can more effectively assess its sustainability. Accountants can analyze a company's financial data, prepare a cash flow statement, and provide insight into a company's liquidity and potential areas for cost optimization. This information helps a company make informed decisions about expanding its operations or securing financing for new projects.

Healthcare Provision Group (Fictitious Company)

Bookkeeping Scenario:

Healthcare Provision Group, a medical practice, primarily relies on bookkeeping to manage its finances. It records patient payments, operating expenses and supply purchases. Although it maintains accurate transaction records, it may be difficult to assess its overall financial health or plan for future growth.

Accounting Scenario:

Choosing financial accounting over bookkeeping allows Healthcare Provisions Group to access a broader financial perspective. Accountants may compile financial statements, assess revenue trends and calculate key financial ratios. This enables medical practices to make informed decisions about whether to hire additional staff, expand services, or invest in advanced medical equipment.

In these instances, financial accounting provides much more than basic record-keeping. It equips these fictional companies with the tools and insights needed for strategic planning, financial analysis, and long-term success. While bookkeeping is necessary to maintain the accuracy of transactions, financial accounting is preferred when businesses want a deeper understanding of their financial performance and the ability to make informed decisions based on that data.

Conclusion

In conclusion, while both bookkeeping and financial accounting play essential roles in the management of a company's financial records, financial accounting is preferred when businesses in the United States wish to gain a deeper understanding of their financial position and make informed strategic decisions. Are. Fictional companies such as Tech Innovators Inc., Green Energy Solutions LLC, and Healthcare Provisions Group show how financial accounting goes beyond basic record-keeping, providing comprehensive financial statements, in-depth analysis, and valuable insights.

Financial accounting enables companies to assess profitability, evaluate assets and liabilities, analyze liquidity, and plan for future growth with greater accuracy. It ensures compliance with regulations, assists in tax optimization, and supports budgeting and forecasting efforts. Ultimately, financial accounting empowers businesses to make well-informed decisions that contribute to their long-term financial success and stability. Therefore, choosing financial accounting over basic bookkeeping is the preferred option for companies operating in the United States, when looking for a more holistic financial perspective and strategic advantage.

Comments